Top Mistakes to Avoid in Multifamily Real Estate Investing

Multifamily real estate investing can be one of the smartest ways to build long-term wealth and generate steady passive income. But just like any investment, it comes with its share of risks—and many beginners (and even seasoned investors) make costly mistakes that can derail their goals.

Whether you’re just starting or looking to grow your portfolio, understanding what not to do is just as important as knowing what to do. In this post, we’ll go over the top mistakes you should avoid when diving into multifamily properties, and how you can make smarter, data-backed decisions.

1. Skipping Due Diligence

Many new investors get excited by shiny multifamily real estate investing opportunities and jump in without proper research. This is one of the biggest pitfalls.

Due diligence means reviewing everything—property conditions, cash flows, local market trends, tenant history, and more. It’s not just about inspecting units, but also verifying income and expenses, understanding lease agreements, and reviewing zoning laws.

Tip: Use tools like AI Multifamily Underwriting to help you analyze deals more effectively. Books like The AI Advantage provide a step-by-step guide to using AI in your due diligence process.

2. Ignoring the Power of Location

You’ve heard it before: In real estate, the location is paramount. But it’s not just about picking a popular city. You need to dig deeper into neighborhood trends, job growth, schools, safety, and access to public transport.

An amazing property in the wrong location can turn into a terrible investment.

Look for: Areas showing strong rental demand, low vacancy rates, and signs of future development. This helps ensure your property investments stay profitable.

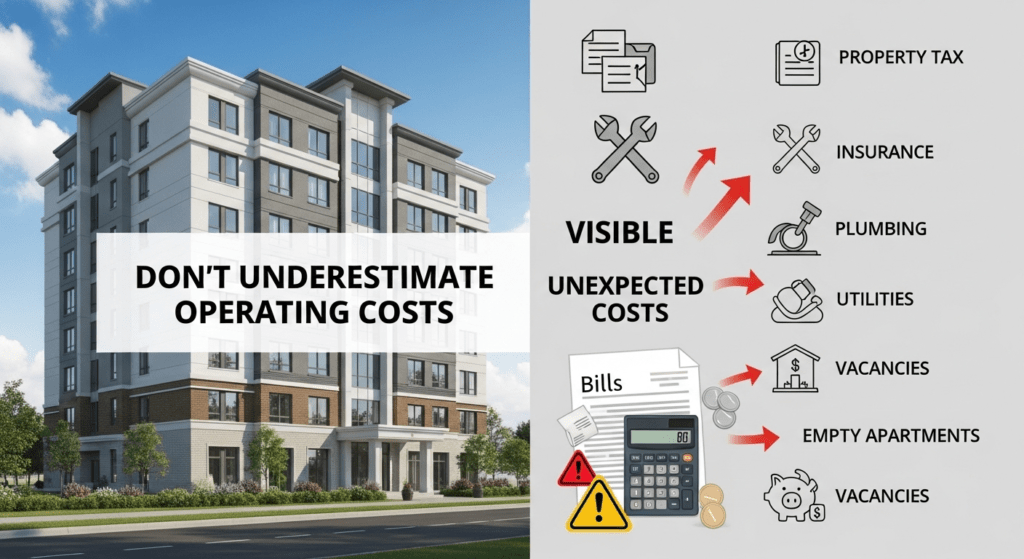

3. Underestimating Operating Costs

It’s easy to focus on purchase price and rental income, but forgetting about operating costs is a big mistake. Property taxes, insurance, repairs, management fees, utilities, and vacancies can eat into your profits quickly.

Many investors also forget to budget for capital expenditures (roof, plumbing, appliances, etc.), which can cost thousands.

Pro tip: Always leave a buffer in your financial plan to cover unexpected costs. And don’t depend only on hopeful cash flow projections.

4. Not Having a Clear Investment Strategy

Some investors try to do everything at once—flip properties, manage tenants, raise capital—all without a clear plan. Without direction, you’re likely to get overwhelmed or make poor decisions.

Are you investing for long-term wealth? Do you want immediate passive income? Are you more interested in residential property or commercial real estate?

Define your goal early, and stick to a strategy that fits your risk tolerance and lifestyle.

5. Overleveraging

Yes, real estate allows you to use other people’s money—but taking on too much debt is risky. If interest rates rise or the market slows down, you could end up with negative cash flows or even default.

Avoid using maximum leverage just to buy a bigger property. That’s a trap that’s taken down many multifamily real estate investors.

Stay conservative with your loan-to-value ratio and always have an exit plan in case things don’t go as expected.

6. Neglecting Property Management

Managing multifamily properties takes time, energy, and people skills. If you don’t manage tenants well, you risk high turnover, late rent, and damage to the property.

If you’re not ready to be a hands-on landlord, consider hiring a professional property manager. Yes, there’s a management fee, but it can save you headaches in the long run.

Passive investors often make this mistake—forgetting that real estate isn’t 100% passive unless managed well.

7. Failing to Analyze Deals Properly

Not every apartment real estate investing deal is a good one. Some look great on paper but don’t perform in real life. That’s why analyzing your numbers is critical.

Use tools to run your pro forma, estimate your returns, and stress-test your assumptions.

Want help with this? Check out The AI Advantage—a powerful book that teaches you how to use AI tools to underwrite multifamily real estate investing deals efficiently.

8. Not Understanding Your Legal Structure

Many beginners don’t think about how their investments are legally structured. Are you buying as an individual, through an LLC, or via a private placement deal?

Your legal structure affects taxes, liability, and how you raise capital from others. If you’re pooling money from investors, you must comply with SEC laws.

Learn about structures before you sign anything. Consider talking to a real estate attorney or tax advisor.

9. Forgetting to Plan for Rising Interest Rates

Your mortgage, cash flow, and returns are all influenced by interest rates. Many new investors lock in deals assuming today’s rates will stay the same forever.

In reality, interest rates are always changing—and can have a big impact on real estate investments.

Strategy tip: Consider fixed-rate loans, and always factor in a rate cushion when forecasting your future expenses.

10. Trying to Do It All Alone

Real estate is a team sport. Trying to handle everything yourself—from sourcing deals to financing, managing tenants, and running numbers—can slow you down or lead to mistakes.

Build a team that includes a real estate agent, lender, attorney, accountant, and contractor. If you’re new, find a mentor or join a community like Multifamily Mindset or check out content on Multifamily Real Estate for Beginners.

You’ll learn faster, avoid rookie mistakes, and find better deals.

BONUS: Ignoring Technology and AI Tools

In today’s market, those who adopt modern tools have a huge advantage. Traditional spreadsheets are great, but integrating AI Real Estate technologies into your analysis can take your investing to the next level.

AI can help you:

- Identify strong markets faster

- Underwrite deals more accurately

- Predict cash flow and risk better

- Streamline your analysis process

If you want to truly embrace the future of real estate, get your hands on The AI Advantage: How to Use AI to Underwrite Multifamily Development by Tim H. Safransky.

This book is a game-changer for investors looking to modernize their approach. It’s practical, clear, and filled with real-world strategies to help you make smarter decisions.

Final Thoughts

Investing in multifamily property can be a powerful path to financial freedom. But avoiding these common mistakes is key to becoming a successful investor.

Take your time. Do your research. Use technology. Build a smart team. And most importantly, never stop learning.

Ready to make smarter investments?

Grab your copy of The AI Advantage and discover how AI can transform your approach to Multifamily Real Estate Investing.