Mindset Shifts for Success in Multifamily Real Estate Investment for Beginners

Getting started in Multifamily Real Estate Investment for Beginners can be exciting—and overwhelming. Many new investors focus heavily on numbers, strategies, and property details, but often overlook one major factor that determines long-term success: mindset.

In real estate, your mindset shapes your actions, decisions, and ultimately, your results. And this mental game is rapidly changing in the era of automation and artificial intelligence. In The AI Advantage: How to Use AI to Underwrite Multifamily Development by Tim H. Safransky, the focus is not just on tools and data—but how to think like a modern investor. This blog walks you through the mindset shifts every beginner needs to succeed in multifamily real estate investing.

Why Mindset Matters in Multifamily Real Estate

Starting out in multifamily real estate investment for beginners isn’t just about finding the right property. It’s about mentally getting ready for the journey. You’ll face setbacks, learning curves, and doubts—but staying focused on long-term growth will keep you going.

As The AI Advantage highlights, success today isn’t about working harder—it’s about thinking smarter. This means using AI tools, building the right habits, and embracing a mindset of continuous learning. To thrive in multifamily housing, you need to believe in your ability to grow—even when challenges appear.

Shift from Short-Term Gains to Long-Term Wealth

It’s tempting to chase quick profits, but multifamily real estate investment for beginners is a game of patience. The best investors don’t flip and run. They buy and hold—letting rental income, property appreciation, and smart reinvestments build long-term wealth.

In The AI Advantage, Safransky emphasizes the power of building a stable real estate portfolio using long-term thinking. With the right underwriting approach, guided by AI, investors can make decisions that pay off steadily over years—not just months.

Takeaway: Think decades, not days. Reinvest your rental cash flow, and let time and real estate ROI work in your favor.

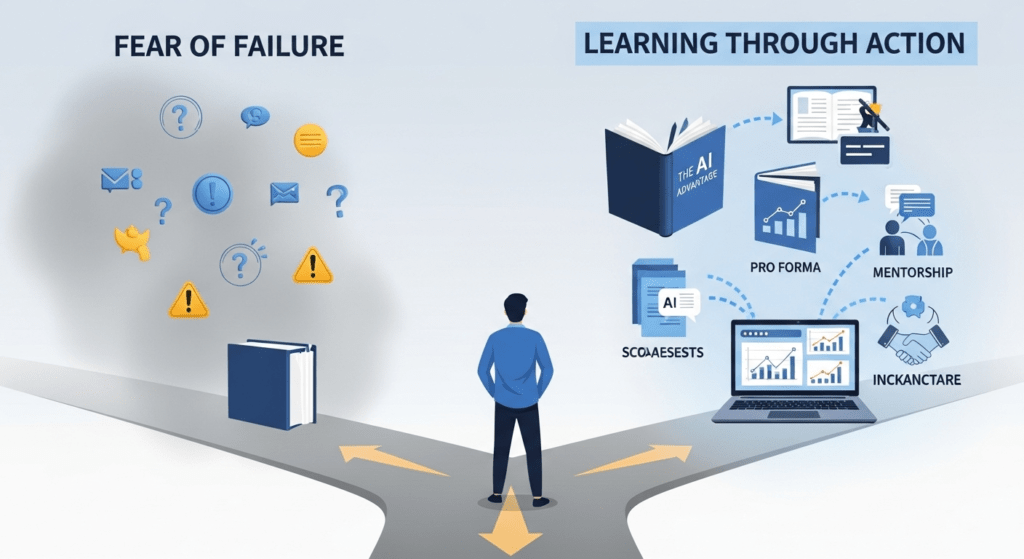

From Fear of Failure to Learning Through Action

Many beginner real estate investors freeze up with “what if I fail?” fear. But growth only comes when you take action. Every mistake is a lesson, and every lesson gets you closer to mastery.

Safransky’s The AI Advantage shows how tools like AI multifamily underwriting can reduce risks and boost confidence—even for beginners. You don’t need to guess. AI can help you analyze deals, prepare pro formas, and predict financial feasibility with real data.

Combine this with mentorship, networking, and books like The AI Advantage, and your fear fades. You gain clarity, and clarity fuels progress.

From “Doing It All” to Leveraging Tech and Teams

One common beginner mistake? Trying to do everything yourself—finding deals, managing tenants, fixing toilets, and crunching numbers. But multifamily property investment is a team sport.

You need brokers, lenders, property managers, contractors—and yes, technology. With AI, you don’t have to manually evaluate dozens of deals. Tools mentioned in The AI Advantage allow you to automate deal analysis, assess risk, and save time.

🔧 Pro Tip: Use tech to handle the heavy lifting and focus your energy on high-level decisions.

From “I Need to Know Everything” to “I Just Need to Start”

Perfectionism delays success. You will never start if you wait until you “know everything.” Instead, start small—maybe with a duplex, triplex, or even a joint venture.

As Safransky points out in The AI Advantage, success is built through learning by doing. AI doesn’t replace your judgment—it supports it. The sooner you get in the game, the faster you’ll learn and grow.

Mindset Shift: Progress > Perfection. Start with what you know, and grow with experience.

From Trading Time for Money to Building Passive Income

Most people are used to earning income by trading time for money. But multifamily real estate flips that script. By investing in rental income strategies, you build passive income real estate—money that flows in whether you work or not.

Additionally, you may grow this model more quickly with AI technologies. As The AI Advantage explains, technology allows you to underwrite more deals in less time, spot better opportunities, and manage properties more efficiently.

Goal: Build a portfolio that funds your freedom—not just your next paycheck.

Conclusion: Embrace the Investor’s Mindset

Success in multifamily real estate investment for beginners isn’t just about buying buildings. It’s about building the right mindset. Shift your focus from fear to action, from short-term wins to long-term wealth, and from doing it all to building a strong support system—tech included.

If you’re serious about transforming your approach, grab a copy of The AI Advantage by Tim H. Safransky. It’s a practical, step-by-step guide to navigating the world of AI real estate and unlocking smarter, more confident investments.

Buy The AI Advantage on Amazon today and take the first step toward smarter investing.

Subscribe to Our YouTube Channel

Want to learn more about how AI is changing the real estate game?

Subscribe to our “AI Multifamily Developments” YouTube channel for weekly tips, strategies, and walkthroughs designed for new investors like you!